Retirement is about more than your finances.

Root’s process is born out of a genuine interest in helping you. We believe the best way to give you the highest chance of success is by actually getting to know who you are.

Deep roots.

We call our process The Sequoia System because, unlike many firms, we don’t start with the numbers. To build a plan with a strong foundation, we begin with your roots to get a real picture of what you want most out of life.

It’s a 4-step method that helps us intimately understand your situation so our recommendations are thoughtful, researched, and always made with your best interest in mind. We’ll systematically formulate a financial plan so you can start to experience freedom with your money.

And like the great Sequoia tree, this helps us develop a robust retirement that can weather any storm.

"...BLOWN AWAY by their knowledge and expertise, I feel like I have been empowered in my relationship with finances in general."Brooke H.

"I can't say enough about this team. I can sleep at night knowing my 33.5 years of hard work is in good hands... I have never left any reviews on anything but I felt compelled to do so to help others..."Dave F.

"I love the in depth Zoom meetings we have... not only about our investments but also about our purpose in retirement... we feel more confident and excited about retirement than ever before."Rick S.

Root Financial Partners has not provided any compensation for the testimonials shown. The testimonials shown have been selected from among all client feedback. To our knowledge, no other conflicts of interest exist regarding these testimonials.

Human-first financial planning.

There’s no substitute for quality time spent with you. Think of us as your retirement therapist. Together, we’ll get you where you’d like to be.

Our planning process.

What to Expect-

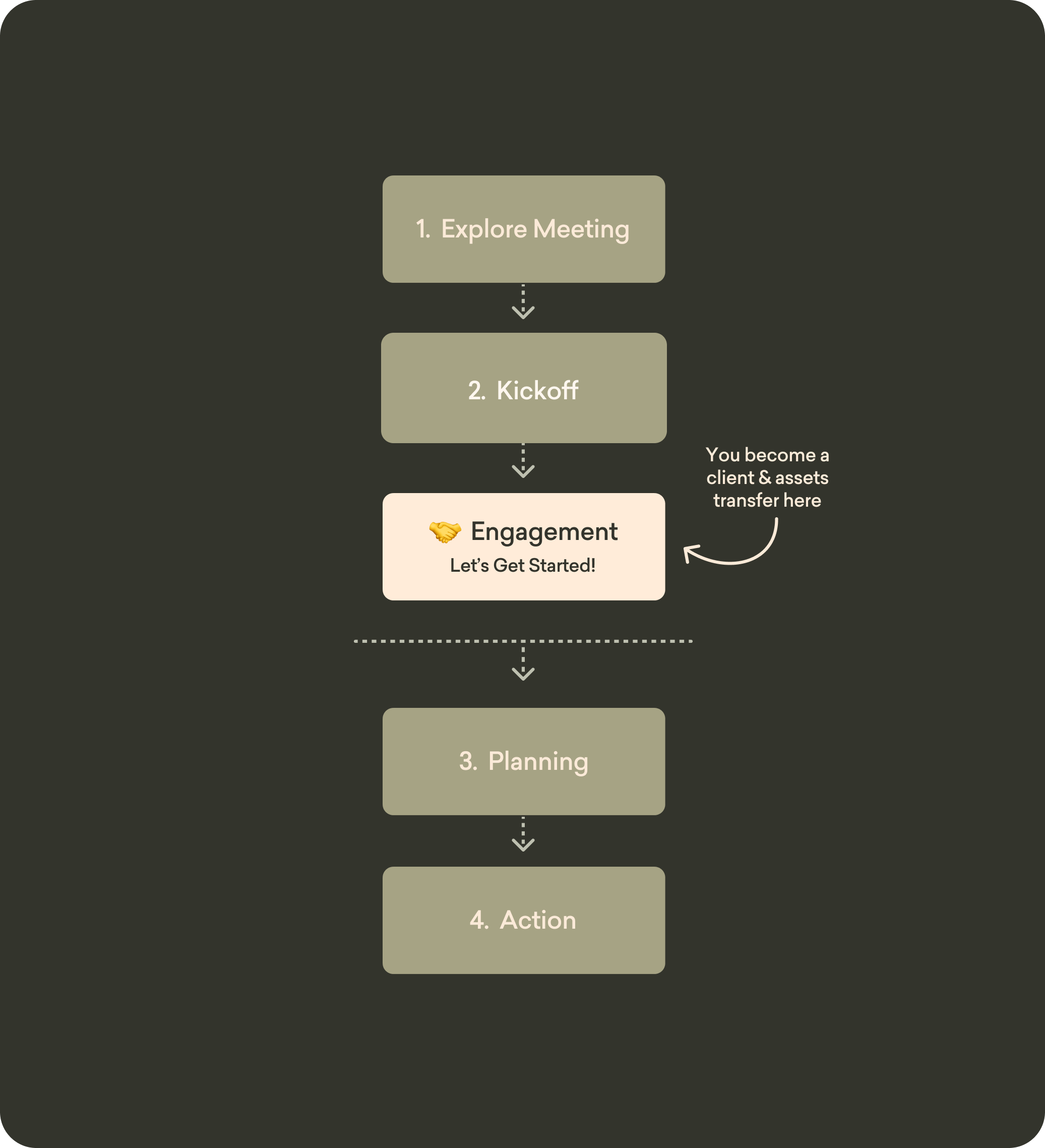

Before you become a client, you’ll schedule an Explore Call with our team to see what working with Root is like. We’ll get to know you and what you’re looking to accomplish. If we both determine it could be a good fit, we’ll match you with the advisor best suited to your situation to begin planning.

After you sign the necessary documents to become a client, you’ll start your journey through the Sequoia System with your Root advisor.

-

Your Sequoia System journey begins with finding your purpose. The goal is to dig deeper into what we discussed during our Explore Call. We’ll introduce tools to help clarify your purpose, gain visibility into expenses, and review your early financial plan.

Behind the scenes, we’ll be crunching numbers to optimize your plan. Over the next several weeks, we’ll schedule meetings to review income, investments, taxes, and insurance and estate planning. For each topic, we’ll identify any actionable items to ensure you stay on track to reach your goals.

-

We’ll analyze your current retirement trajectory and coordinate your portfolio income with other factors like Social Security. This helps us identify opportunities for improvement.

We’ll ensure you have a plan to maximize your income to support a meaningful retirement. You’ll also be able to see a projection of your income throughout the entirety of your retirement.

-

Once we understand your purpose in retirement and maximize income to get there, we can see what your investments need to do to support your income.

We formulate recommendations based on the data we’ve gathered. You’ll see the strategy we outline and have the opportunity to ask questions. It’s important you feel comfortable and clearly understand everything before moving on.

-

Because taxes could be your largest expense, a sound tax strategy is essential to helping you keep more of your nest egg. Our goal is to reduce what you pay as much as possible now and in the future.

You’ll see an analysis of what tax implications you can expect. We’ll give recommendations to optimize your plan.

-

With Root, you get full 360-degree coverage of your retirement journey. There are no add-ons or additional fees. We’ll analyze your current estate plan to ensure your goals are reflected appropriately.

The best plans are laid to waste if there aren’t systems in place to fully protect them. We’ll review your insurance and estate coverage so you’re covered no matter what happens.

With this holistic view, we can provide a higher level of service.

-

After implementation, we’ll be with you the whole time. We continually evaluate your needs over the years to ensure that we’re optimizing what you’ve worked so hard for. We’ll track your progress and, with your approval, make adjustments along the way.

You’ll meet with your advisor each Spring and Fall and check in with our team in the Summer. In between regularly scheduled meetings, we’re still always there for you, just a phone call or email away.

Frequently Asked Questions

Answer

We work with people from all walks of life. That said, we are a business, and to remain viable, we must receive compensation. Our best-fit clients are those who have found some success and built a portfolio of at least $2 million. They’ve done an excellent job of saving but don’t want to be burdened with the responsibility of doing everything needed to get the most out of their money and their retirement planning.

If we can’t work with you, we’ll do our best to answer any questions you have and point you to someone who can. Please don’t hesitate to reach out today to see what’s possible with your financial planning.

Answer

We charge a fee that’s a percentage of the value of the investments we manage, which is debited directly from the account:

—1% on the first $1,000,000 we manage

—0.75% between $1,000,000 and $5,000,000

—0.50% between $5,000,000 and $10,000,000

—0.40% between $10,000,000 and $25,000,000

—0.30% between $25,000,000 and $50,000,000

—0.25% between $50,000,000 and $100,000,000

—0.20% on amounts above $100,000,000

We don’t get paid through any type of commission, kickback, or other undisclosed revenue sources. There’s no additional charge for the tax and estate planning we provide.

Answer

Our mission is to help you get the most out of life with your money. To do that means we want to take as much of the planning off your plate as possible. We help clients with:

—Retirement planning

—Investment management

—Tax planning

—Estate planning

—Insurance review

—Cash flow planning

And everything else needed to ensure you feel calm (and excited) about your financial future.

Answer

Yes.

Your CPA is excellent for accounting for what happened last year. Often, they don’t work on limiting your tax liability in the future.

At Root, we help you look at the big picture and offer strategies to optimize your spending and saving for tax efficiencies. You (or your CPA) will still be responsible for filing your return.

Answer

One key component of Root Financial’s mission is to provide a world-class client experience.

To help accomplish this objective, we work closely with high-quality custodians who allow us to do our best work for you.

We work with both Charles Schwab and Altruist. We don’t work for them—meaning we can determine which custodian makes the most sense based on your situation.

We will talk more in-depth about why these custodians supports us in creating a top-tier investment experience during our explore meeting.

Mark S. DisclosureWe chose Root for their holistic and comprehensive approach and could not be happier. The value they added was easy to see. After implementing the plan recommended… we are in a much better place to be on track for retirement. We have peace of mind knowing we are in good hands. Very responsive and great client service. Highly recommend.

Root Financial Partners has not provided any compensation for the testimonials shown. The testimonials shown have been selected from among all client feedback. To our knowledge, no other conflicts of interest exist regarding these testimonials.

At a glance.

Big-firm capabilities with down-to-earth principles.

We’re headquartered in San Diego, CA, and we work remotely with clients nationwide. We pride ourselves on our out-of-the-box thinking and personalized service. You’ll never receive pre-packaged, cookie-cutter financial advice.

Your money is in good hands.

Professional investment managers and CERTIFIED FINANCIAL PLANNERS™ oversee your investments. While you’ll have a primary retirement financial advisor you work with, we take a whole-team approach to help give you the best opportunity for success.

Assets are protected and insured by an independent third-party custodian for safekeeping.

You’re in control.

Having an experienced partner like Root in your corner helps ensure you have more visibility and control over your money than ever before. We’ll help you gather an intimate understanding of your finances and navigate your retirement planning with clarity.

While you can rest well knowing we’re always on watch, you’ll also have quick and easy access to your money through the latest technology available.

Let us take a weight off your shoulders.

Take the first step by scheduling your

Explore Call below.