This past Saturday after a morning workout at my gym in Austin, TX, I popped into the sauna for 10 minutes before leaving. Little did I know there was an investment conference happening in the sauna! I sat down and within moments, the fellow next to me started chiding his buddy: “I’m telling you, this SUI coin is a slam dunk.”

He also mentioned a retail stock, I want to say it was Dave & Buster’s which I could not believe for the life of me is publicly traded!

His comment on the stock was pure gold: “Listen, just put a couple thousands bucks in it, wait two years, and thank me later.”

It was like a scene out of a movie. Where do you go on a Saturday morning for stock tips? Duh, the local Austin sauna.

This got me thinking though, we’ve all heard something like this at one point or another. Most of us know it’s just useless bluster, but what is the proper response? Not the actual response you would verbalize to that person—because if they are in the sauna dishing out crypto/stock tips, they might not be all that receptive 😀—but the internal dialogue response of you with your investment self.

In my opinion, Ken French summarized it eloquently in a 2024 interview with Meb Faber:

“It appears by the behavior of many investors…[that] investors are so overconfident in their ability to pick winners that they are willing to systematically lose.”

For sauna purposes, my thought was: “the man in the sauna is so overconfident in his ability to pick SUI and PLAY (what a freakin’ awesome ticker) that he is willing to systematically lose.”

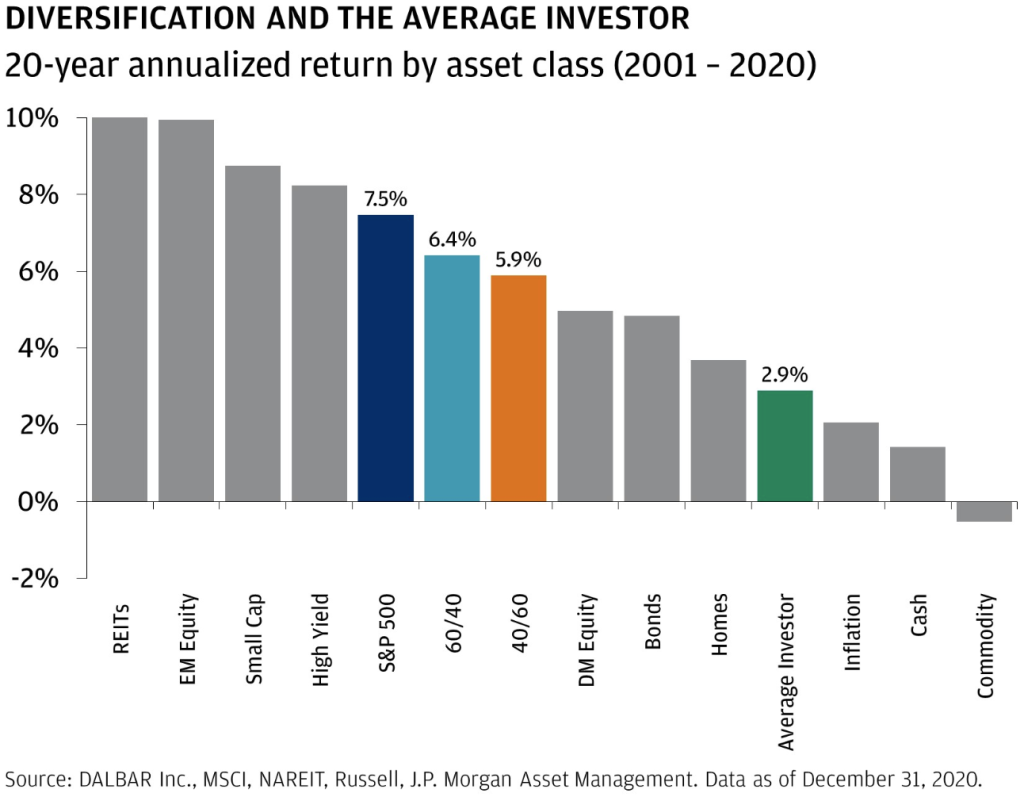

Among the piles of evidence, this one from JPMorgan Asset Management sticks out:

Ken French’s longtime research partner, Gene Fama, also has some timely thoughts on the matter. From Fama’s recent FT Interview:

“Fama has a simple rejoinder to whoever might point to the stock market insanity du jour and howl with mirth: “If prices are obviously wrong then you should be rich,” he says.”

I’ve heard it hundreds of times. “How can the market be efficient if Nvidia is up 1,700% over the last 5 years?” The simple response is, “if prices are obviously wrong then you should be rich.”

Yet for many this isn’t good enough. Each year, thousands of investors must try their hand in the market only to systematically lose to learn this lesson. Or worse yet, they win for a few years and are convinced they’ve figured out how to make money in the market, remember the TikTok investing couple? I’m convinced that’s why the JPMorgan chart above never drastically changes.

What a powerful statement from Fama though. For what it’s worth, my statement would look something like: are there talented investors who can consistently predict winners in the public markets? Yes. But there are much, much fewer of these investors in the market than the public or media leads you to believe. What’s worse, they are almost impossible to pick out ahead of time—because if they’re already a proven commodity, they would not need anyone’s money! So anyone proclaiming they can produce money out of thin air and then proceeding to ask you for your money…yeah, that’s an oxymoron.

In case the ramifications aren’t obvious, let’s hear from Fama once more:

“The efficient market hypothesis is just “a model”, Fama stresses. “It’s got to be wrong to some extent. The question is whether it is efficient for your purpose. And for almost every investor I know, the answer to that is yes. They’re not going to be able to beat the market so they might as well behave as if the prices are right…”

You’re looking at one of the rare times where Fama bridges the gap between theory, practice, and behavior. Be sure to take note! You can either take it from Gene or learn for yourself in the stock market, but I must warn…the market charges an expensive tuition bill! Don’t let the sauna stock FOMO getcha!

CONSIDER:

Two thoughts on luck and two thoughts on leverage:

“You need to make yourself a big target for luck and the way to do that is to be curious, try lots of things, meet lots of people, read lots of books, and ask lots of questions.” – Ed Catmull

That might seem obvious, but let’s take Charlie Munger’s approach and “invert, always invert.”

How can you ensure that you will not get lucky? Stay busy so you don’t have time to think. Find your comfort zone and rarely stray from it. Only speak with the people you must. Do not read unless it’s absolutely required. Aim to figure things out with little help (mostly on your own).

–

“As debt increases, you narrow the range of outcomes you can endure in life.” – Morgan Housel

“I’ve never believed in risking what my family and friends have and need in order to pursue what they don’t have and don’t need.” – Warren Buffett

–

Let’s get after it this week!

Brooks

Brooks Palmer, CFP® is Head of Investments at Root where he helps identify, evaluate, and implement the best investment solutions tailored to clients’ needs. In Full-Court Press, he breaks down what’s happening in the markets—cutting through the noise and jargon—while connecting it to Root’s core investment tenets so you can make the most of your money and your life!