Having the right questions is often more important than having all the right answers.

And as an investor, you will never stop hearing the “right answers” whenever you turn on your TV or read an investment article. But successful investors never settle for the right answer without first asking the right question.

What you need is a filter through which you can process this information to tell if it really is correct.

These nine questions are designing to do just that. They will give you a framework of what you should be asking yourself as an investor to improve your odds of investment success in the long-run.

Question #1 What sort of competition do I face as an investor?

The short answer? Tons.

Millions of market participants buy and sell securities every day and the real-time information they bring helps set prices. This means competition is stiff and trying to outguess market prices is difficult for anyone, even professional money managers (see question 2 for more on this).

This is good news for investors though. Rather than basing an investment strategy on trying to find investments that are priced “incorrectly,” investors can instead rely on the information in market prices to help build their portfolios (see question 5 for more on this).

Source: World Federation of Exchanges members, affiliates, correspondents, and non-members. Trade data from the global electronic order book. Daily averages were computed using year-to-date totals as of December 31, 2016, divided by 250 as an approximate number of annual trading days.

Questions #2 What are my chances of picking an investment fund that survives and outperforms?

Flip a coin and your odds of getting heads or tails are 50/50.

Historically, the odds of selecting an investment fund that was still around 15 years later are about the same.

Regarding outperformance, the odds are even worse. The market’s pricing power works against fund managers who try to outperform through stock picking or market timing.

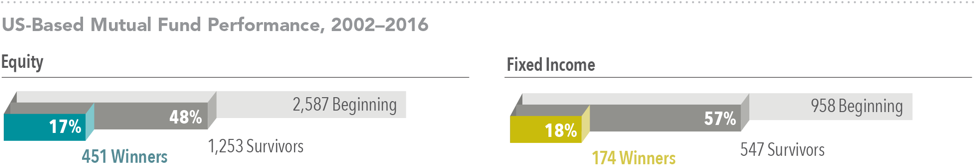

Look no further than real-world results to see this. Based on research*, only 17% of US equity mutual funds and 18% of fixed income funds have survived and outperformed their benchmarks over the past 15 years.

Question #3 If I choose a fund because of strong past performance, does that mean it will do well in the future?

Some investors select mutual funds based on past returns.

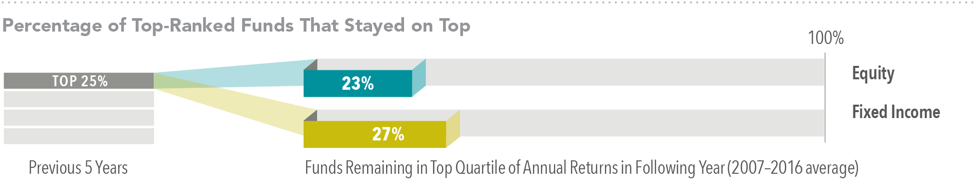

However, research shows that most funds in the top quartile (25%) of previous five-year returns did not maintain a top-quartile ranking in the following year.

In other words, past performance offers little insight into a fund’s future returns.

Question #4 Do I have to outsmart the market to be a successful investor?

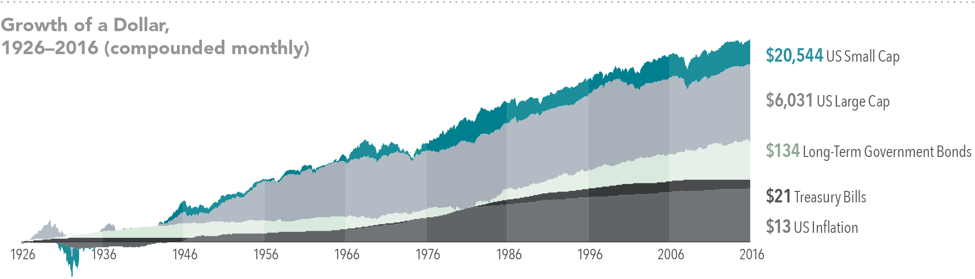

Financial markets have rewarded long-term investors.

People expect a positive return on the capital they invest, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation.

Instead of fighting markets, let them work for you.

Question #5 Is there a better way to build a portfolio?

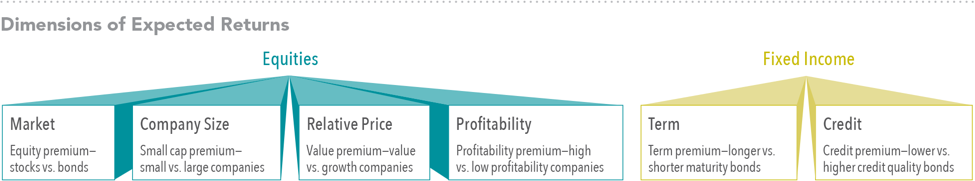

Research shows that different dimensions of the market tend to outperform over time. These parts of the market tend to be riskier, but this risk can be partially offset through diversification.

Instead of attempting to outguess market prices, investors can instead pursue higher expected returns by allocation more or their portfolio around these dimensions.

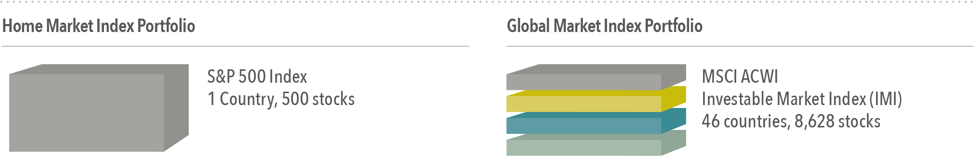

Question #6 Is international investing for me?

Some risks in investing lead to higher expected returns. Other risks don’t add any expected return.

Diversification helps reduce these risks that have no expected return.

But diversifying only within your home market may not be enough. For US investors this means only owning companies in the S&P 500, for example.

Instead, global diversification can broaden your investment opportunity set. By holding a globally diversified portfolio, investors are well positioned to seek returns wherever they occur.

Question #7 Will making frequent changes to my portfolio help me achieve investment success?

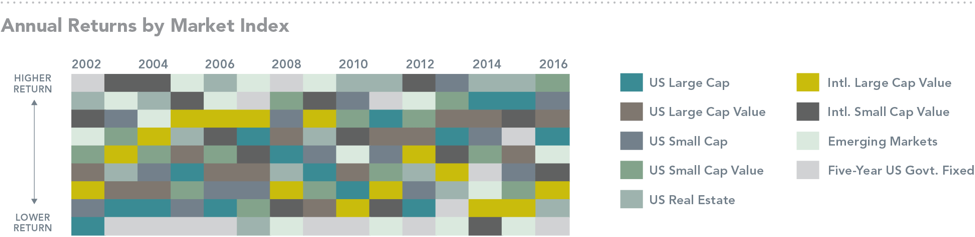

It’s tough, if not impossible, to know which market segments will outperform from year to year. Because of this, it’s better to avoid market timing and other unnecessary changes that can be costly.

Allowing emotions or opinions about short-term market conditions to impact long-term investment decisions can lead to disappointing results.

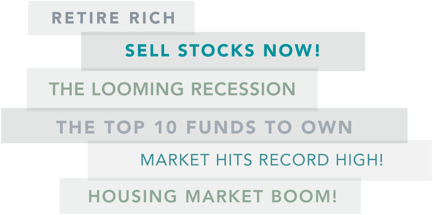

Question #8 Should I make changes to my portfolio based on what I’m hearing in the news?

Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad.

If headlines are unsettling, consider this – they’re working!

Headlines are written to instill fear or greed. These are the emotions that cause readers to want to read more.

Understand that these headlines rarely impact your long-term financial plan and try to maintain a long-term perspective.

Question #9 So, what should I be doing?

Most investment commentary focuses on things that are outside of our control. Rather than dwell on these things, focus on what you can control:

- Create an investment plan to fit your needs and risk tolerance.

- Structure a portfolio along the dimensions of expected returns.

- Diversify globally.

- Manage expenses, turnover, and taxes.

- Stay disciplined through market dips and swings.