Full-Court Press marries three passions of mine:

- The written word, which was kickstarted by the invention of the printing press around 1440

- Basketball

- The proactive nature of a full-court press in basketball and in what we do at Root. Proactive means taking initiative and addressing things before they become problems rather than reacting after they happen.

An opportunity exists to take the complex and jargony language of the investment world and distill it down into understandable bites. Albert Einstein’s “if you can’t explain it simply, you don’t understand it well enough,” was missing one caveat: “…you don’t understand it well enough or benefit tremendously from the other side’s lack of comprehension.” For too long, the financial system has benefitted from the complexity and opaqueness that was intentionally introduced. Transparency and education are cornerstones of what we do here at Root to help you get the most out of life with your money; and to the extent that you’d like to better understand the investment universe, Full-Court Press aims to connect everything going on “out there” back to the core tenets of Root’s investment philosophy. I hope you will follow along and if you’d like to get even more involved, join The Root Collective. With that, here’s this week’s Full-Court Press:

As I’ve taken the plunge to the advisor side over the past month, I’ve made time to read and listen to critics of financial advisors and money managers like Charlie Munger, Jack Bogle, and in this particular interview, Mitch Rales. It’s almost like watching game tape: how will my most formidable and admirable opponents attack? What can I learn from these titans of industry that might sharpen my skillset?

Mitch is the impressive yet somewhat lesser known co-founder of Danaher. The interview was fantastic, which you can find here, and the quote below warranted a response (emphasis is mine):

Paul Bruser: “I’d love for you just to step back and reflect on what that’s like to be so concentrated in one asset? And then what’s going on right now in this transition to you looking for the next generation of founders out there?”

Mitch Rales: “Well, that’s a loaded question. There’s a lot there, but let’s start with Danaher, everybody told me you’re too concentrated, you need to diversify. Thank God, I didn’t listen to any of these schmoes that were encouraging that. And if you think who was encouraging, it was investment advisors, people who know no differently, who look at this with a traditional lens, and it was just wrong. I mean, what better way to stay concentrated than to invest in yourself and what your beliefs and your convictions are on a long-term basis. So, we didn’t diversify. And obviously, that served us very, very well. And during my lifetime, Danaher will always be a very concentrated position because I don’t know where to put that magnitude of dollars otherwise today. What am I going to do? Sell it, pay the tax and put it in index funds? I mean what fun is that? My net worth will be a lot less. We’d rather give it to the foundation and let them start the diversification journey over the long time.”

With the benefit of hindsight, of course Mitch looks back at the success of Danaher and feels that investing in anything else would’ve been wrong, a failure, and that the perceived “experts” were espousing garbage advice.

My expectation for a concentrated position is either a grand slam, like Mitch’s case, or a strikeout, like the many other nameless folks who bet on themselves, stayed concentrated, and lost much of their net worth in (fill in the blank with your favorite stock, asset class, commodity, private company). This is because the range of outcomes for a single company is much wider than the range of outcomes for 500 or 12,000 companies. The chance I have zero dollars, 20 years from now, with a basket of 500 companies is very close to zero. The chance I have zero dollars, 20 years from now, with a single company is much higher (my estimate would be ~40%, per Michael Cembalest’s The Agony and The Ecstasy – see catastrophic losses on Page 3. This is only using data from public companies and the dispersion is much wider in privates).

Mitch’s comments sound eerily similar to the many investors grumbling about advisors who recommended a healthy allocation to international stocks over the past decade–clearly they were wrong, a failure, and espousing garbage advice. Look at what the S&P did for goodness sake!

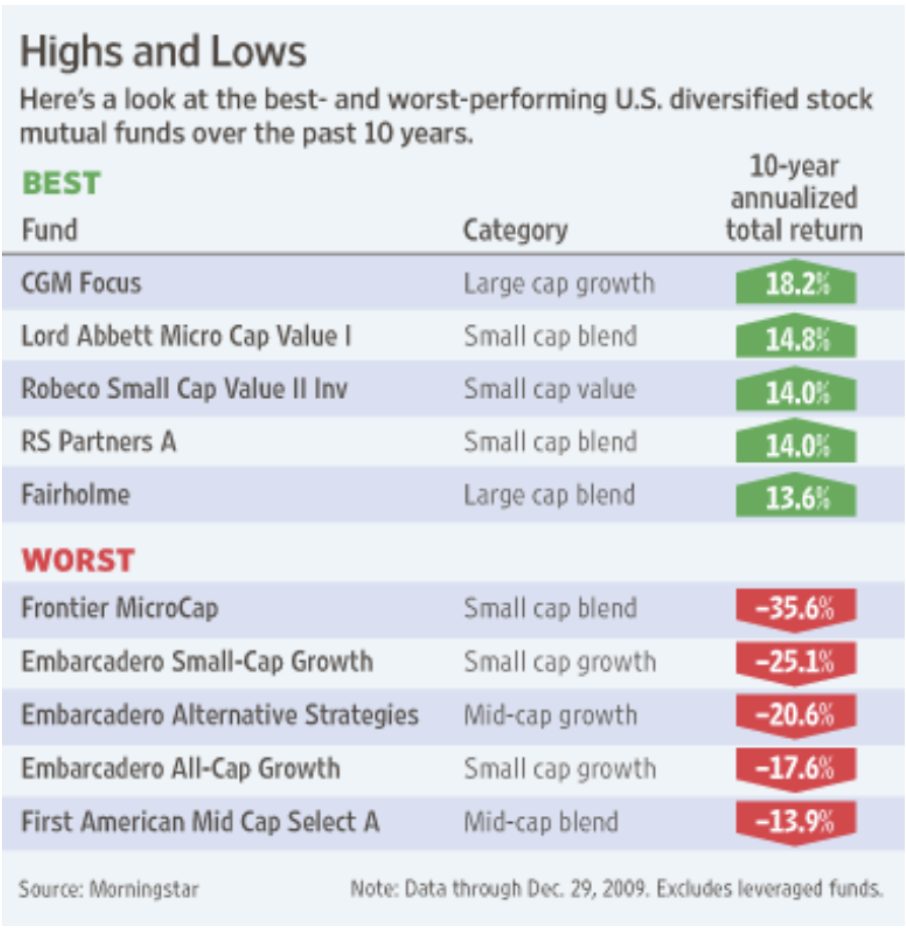

Allocating to international stocks means we’re diversified. Diversified means we’re never going to be top (or bottom) of the rankings for returns in a given year, we’ll never be on either side of the list below:

Source: https://www.wsj.com/articles/SB10001424052748704876804574628561609012716

We’ll let the concentrated, the speculators, and the highly leveraged chase that elusive pot of gold while we block and tackle. Yes, the S&P has crushed over the last 10+ years—and our clients have been handsomely rewarded for their faith in the great American businesses. I’m hopeful this success will continue! But there are two concerns investors should keep in mind:

- Stock price and expected return move inversely (holding all else equal, which it never is). What does this mean?

- A seller comes to me with a condo for sale for $100k. I look on Zillow and see the same unit next door selling for $200k. Assuming there isn’t a major issue with the seller’s unit, my expected return is ~$100k. If I execute the purchase then turnaround and sell it for $200k, what is the expected return for the next owner? Likely closer to zero. Maybe not exactly, but it’s certainly lower than the $100k I made. Price went up, expected return went down. (Please know this example is for simplicity’s sake, there are no dollar bills lying on the sidewalk in the stock market. Run as fast as you can if your advisor is telling you they can find them.)

- Performance chasing is a silent killer. Panic and hysteria are the noisy dangers we always hear about, but performance chasing is hysteria’s stealthy, attractive, deceitful cousin. Keep in mind that ~80% of the people interviewed on CNBC are the few folks who got it right, made the call, skated to where the puck was going and the puck actually arrived. I often joke that anytime one flips to CNBC, your performance chasing blinders are fastened on.

- There will always be a logical rationale for why a great run should continue—just look at the track record, the results speak for themselves!

Like Odysseus, as our ship passes the Sirens, our crew will plug our ears and carry on.

Diversification helps us: 1) work the financial plan, 2) never interrupt the miracle of compounding, and 3) get the most out of life with our money.

PS. I know the chart is from 2009, turns out the pot of gold really is elusive.

CONSIDER:

“Life rewards action, not intelligence. Many brilliant people talk themselves out of getting started, and being smart doesn’t help very much without the courage to act. You can’t win if you’re not in the game.” – James Clear

Profound and true on the one hand, but take this as investment advice, and it’s quite the opposite. Many investors mistake action for production, activity for productivity. While I encourage so many friends, colleagues, and clients I see day to day to take action in setting up their financial flywheel (or engaging an advisor that can help them set it up), once it is in place, you have to let it hum! Sit on your hands and let compounding run wild. The beauty of starting the financial planning process is that it goes from afterthought to priority, then back to afterthought–because you know you’re set up for success and action is the last thing your investment allocation probably needs.

–

Let’s get after it this week!

Brooks