Root has experienced rapid growth thanks to the massive demand we’ve generated for our services. Many people are wondering: What’s next? What will we do with the platform we’ve created?

I’d love to tell you a little about our vision.

The Problem

The financial advice industry is a noble profession—when done correctly. A good financial advisor provides value far beyond their cost and can seriously improve lives.

The problem is that too much of the advice given isn’t helpful, and the little helpful advice isn’t easily accessible.

We want to fix that.

Why Us?

At Root, we’re uniquely positioned to make a real difference in the industry by providing an avenue for good financial advisors to do their best work. There are four key components why we’re in a place to make a massive impact:

- Our platform

- Our Culture

- Our “Newness”

- Our P&L

1. Our Platform

The hardest part about being a financial advisor, especially for those with great technical skills, is getting people to pay you for your advice. Unfortunately, some of the best advisors barely get by because their ability to attract new clients isn’t as strong as their skill in providing good advice to those clients.

Their expertise lies in financial planning, not marketing and sales.

On the flip side, some financial advisors are great at sales, but it takes only a few minutes of conversation to realize their financial advice isn’t any good. They’re better at selling a service than delivering value.

We get millions of views each month between our YouTube channels, podcasts, and digital marketing efforts. These millions of views result in people contacting our office—a lot.

In the last 18 months, we’ve had over 4,000 people reach out to work with us.

We have to turn most of them away (for now).

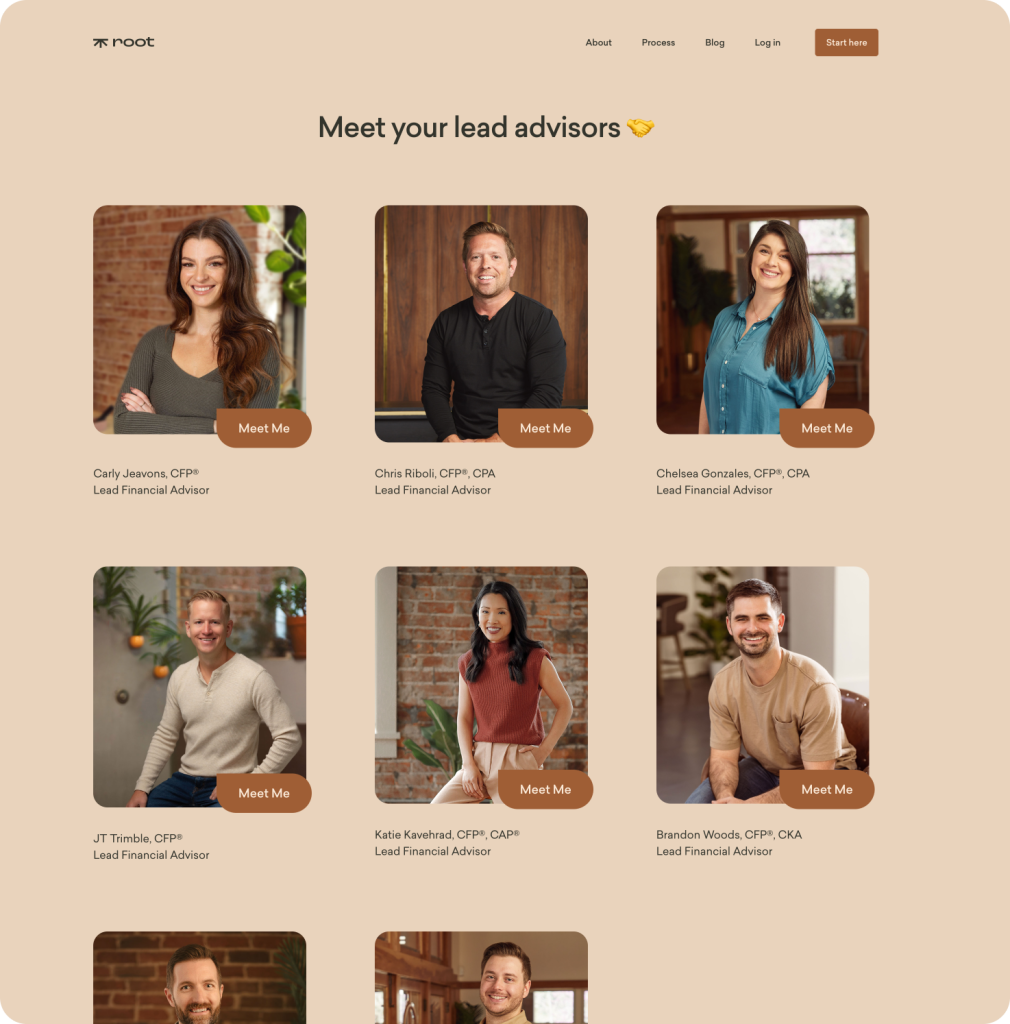

Instead of hiring a slew of sales-focused advisors (who are easy to find) and requiring them to sell themselves, we recruit highly competent financial planners and bring clients to them.

This means we can hire only the best advisors in the industry and enable them to focus 100% on helping our clients get the most out of life with their money.

It’s been a dream come true for those joining Root.

For perspective, it’s not unusual for many advisors, especially newer ones, to spend 25%-50% of their week finding new clients.

Removing this “prospecting time” allows our team to sharpen their focus on the highest-quality service while simultaneously serving more people.

Our annual growth is 187%, and our advisors spend 35% more time with clients than when they were selling. We are onboarding clients at the fastest rate possible without diluting the premium service we deliver.

2. Culture

My favorite part of working at Root is our culture: the people who wake up each day committed to improving the lives of our clients and our team.

The benefits of this culture expand far beyond just having a fun place to work.

Low Turnover

Turnover is expensive. It’s not just a financial cost; it’s an emotional cost, draining everyone’s time, energy, and morale.

When you build a great culture, people want to stay.

How do we do it?

- Give team members a clear vision of how they can grow personally and professionally at Root so they want to build a 30- to 40-year career with us serving our clients and, eventually, our clients’ children.

- A clear, compelling mission with lofty ambitions.

- Hyper-selectivity about the quality of people we bring on.

Attracting New Talent

The average age of a financial advisor today is 55. As the current generation of advisors begins to retire, not enough young people are joining the profession.

This has created significant competition in hiring the top people entering the industry.

The best advisors want to be a part of something established but also innovative. They want to be challenged by something fresh and new. They want to work hard alongside other people they know are doing the same.

At Root, we receive several hundred applications for each job listing we post. Applicants tell us that what draws them to Root is the energy, vitality, fresh thinking, and quality of people committed to being the absolute best versions of themselves.

Bringing The Whole Self to Work

A happy team is just plain good business. It’s critical to our success that our advisors bring their best selves to serve our clients. Dealing with your money can be scary. Working with someone who loves what they do makes it much less stressful (and even fun!).

3. Newness

Most large financial firms are several decades old, and their service reflects that.

Their systems and legacy technology are often from the previous century, and team structures work under sales commission-based incentive programs. Old structures like these will not work for a mission-based organization.

They also tend to lack motivation. The seldom-spoken truth is that many advisors at older firms are “over the hump.” They’ve already made it, and they’re now enjoying the fruits of their labor. They’re taking home large paychecks while working significantly less than they did at the beginning of their career. What incentive do they have to scrap the foundations their businesses were built on and start over?

At Root, we’re committed to staying on the cutting edge. Disruption is the name of our game.

4. Our P&L

It isn’t flashy, but Root has a very attractive balance sheet, which ultimately feeds into our ability to deliver on our mission.

Low Overhead

While we have physical office presences in San Diego and Los Angeles, most Root team members are entirely virtual and distributed across the United States. Our rent cost is practically non-existent as a line item on our P&L statement.

Many larger firms also pay several hundred thousand dollars yearly in technology and software costs. More expensive doesn’t always mean better in the financial advice industry.

CRM systems, portfolio accounting, client portals, financial planning tools, tax and estate planning, task management, and internal communications all require software.

Much of this legacy software is disjointed and rarely works well. Until recently, tech firms weren’t hyper-focused on the financial advice industry, so historically, you didn’t get much in the way of innovative solutions.

Thankfully, that’s changed more recently, but many firms haven’t.

Instead, they stick with their bloated and clunky tech. They know there are better solutions, but the thought of migrating hundreds or thousands of client households to a new, better tech platform isn’t something they’re keen on doing. So they keep writing big checks for old software.

The technology Root is built on is better, lighter, and more affordable than most incumbents. This allows us to pay a lower cost per client to support all our technology needs to run a hyper-efficient firm.

Client Acquisition Cost

Without our wildly successful marketing platform discussed above, we would have to spend significant revenue on sales.

Many consulting firms recommend that financial advisors spend around 8% of their annual revenue on marketing. Root’s marketing costs are net zero.

In fact, YouTube actually pays us to market. The revenue we receive from YouTube covers the cost of time spent outlining, producing, editing, and promoting our content.

Most firms spend thousands of dollars and countless hours of human capital marketing to grow their business. Thanks to our platform, we can reinvest the cost of acquiring clients (in time and money) back into our business—building the best team possible and serving clients at a high level.

This helps us better deliver on our Master Plan to make financial advice better and more accessible—and ultimately—on our mission to help as many people as possible get the most out of life with their money.

How We’ll Disrupt The Industry

So, how will we take our unique position and execute to revolutionize the financial advice industry?

Phase 1: Expand Client Base

We’ve built something really special at Root and as a result, thousands of people reach out to work with us.

Right now, we have to turn away far too many of those people. We can’t adequately serve our demand at the high standard we hold ourselves to, so we limit the number of clients we onboard.

Phase one focuses on creating the capacity to expand our ability to serve more people who need our help.

We’ll do this in two ways over the coming years.

1. Growing Our Team

Each financial advisor has only the bandwidth to serve a certain number of clients. Every time we hire a new advisor, we increase the number of clients we can serve.

Thanks to our low cost of acquiring new clients, we can allocate more of our revenue to expanding our team.

We’ll continue to do so at a rate that ensures we can serve clients at the highest standard and that our team doesn’t get so overworked that we stop enjoying what we get to do.

At the time of writing this, 4,000 people have reached out to us to work with us in the last 18 months. On our new business calendar, we have a 4-month wait to schedule a call.

People genuinely and often urgently need our help, and I’m not happy about making them wait.

So, step one is hiring more great advisors and teaching them our way of doing things through mentorship and enrollment in our internal training program, Root University. These advisors will help us increase the number of people we can serve while increasing firm revenue.

We’ll reinvest those profits into hiring more team members and expanding our client base in non-traditional methods.

2. Scaling Advice

Not everyone will have the resources or desire to work with an advisor in the traditional sense. And while we’ll never try to be everything to everyone, we want to make our services available to as many people as possible.

Our roadmap includes building an online community for people who need help with their money.

A community where financial planners can conduct one-to-many planning sessions to help people with their plans. One where we can bring in various subject matter experts to help community members.

This becomes the high-volume, low-margin complement to our (relatively) low-volume, high-margin full-service offering.

This model offers us two distinct benefits:

- We can serve people we previously weren’t able to.

- If we can achieve enough scale through our online community, we can use those profits to lower the cost of our full-service planning, making it more accessible to more people.

These profits create an opportunity to do more than add additional team members.

Phase 2: Add & Improve Services

While growing our team, we also want to expand our services to move closer to an “all-in-one” solution.

Beyond traditional financial advice, we’ll bring in retirement coaches, speakers, and other influential people who can help us pursue our mission of helping as many people as possible get the most out of life with their money.

Phase 3: Make Advice More Affordable

The scale we create fuels our ability to compress the cost of financial services over time. The profit we make on our service from those who can afford full-service planning enables us to continue expanding our platform to serve more people at a lower cost.

In many cases, free.

There are many firms out there that charge less than we do today. Many of these firms are run by solo advisors who are outstanding financial planners. But most of them will never grow far beyond their current size. Even if they wanted to, they don’t have the profitability to scale at a rate fast enough to drive any meaningful change in our flawed industry.

And there’s nothing wrong with that. They may have no desire to fix financial services.

But we do.

Join Us

Clients who work with Root today are partnering with us to deliver on our long-term vision and mission.

Their fees are reinvested into the business.

Yes, we hope our clients love the service they receive today. But we also hope they know they’re contributing to something that will improve the lives of many others.

Whether you’re a current client, future client, or future team member reading this, we hope you’ll join our mission.